Financial Goodies

These are the companies, tools and websites I personally use to help me grow my net worth while I do my day job.

-

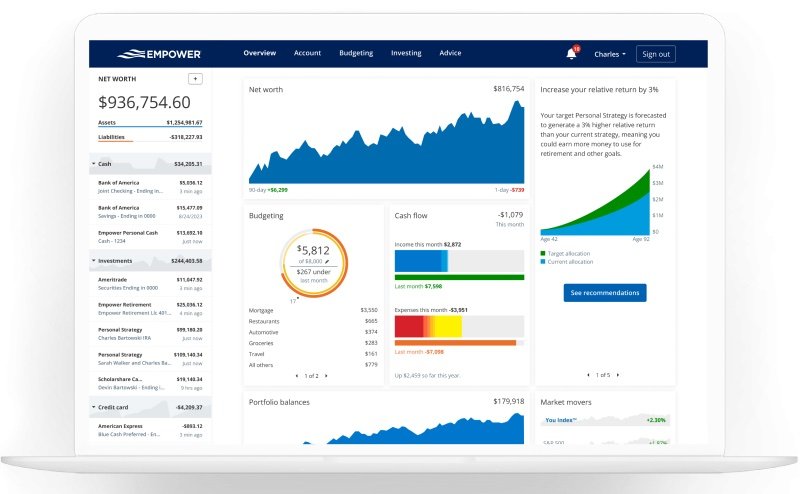

Empower Dashboard - the one to rule them all

The Empower Dashboard (formally Personal Capital) takes your entire investment and financial life and shows it to you in one well-designed place. Oh yeah, and it’s free. Open one; it’s just incredible.

-

Maxmyinterest.com - the highest savings rates

I found maxmyinterest after the Wall Street Journal’s Jason Zweig wrote about it. Want the highest savings account rates in the country? Max opens an account for you and moves your money. Perfect for your emergency fund.

-

Schwab - a fab brokerage platform

Charles Schwab & Co. is a financial services company that pioneered low-cost stock trading, and their customer service is super. They have a nice-looking website and phone apps. This is an excellent choice for investors who want flexibility and want to get more involved.

-

Quickbooks Online - make your biz run seamlessly

Big John, my accountant, finally made me use Quickbooks online, and boy, was he right. It’s mission control for your whole business, invoicing, paying vendors, everything. It downloads and matches your credit card and bank transactions and creates any report you want on your biz—total time saver.

-

Square - credit card and ACH payments made easy

I use these guys for my studio business, StudiowerksDC. They make invoicing clients so easy. Clients can use credit cards, ApplePay, and ACH bank transfers.

Why list these companies and tools here? To find the right tools it took me years of research, trial and error, and talking to people a lot smarter than me (cheers Josh!). Hopefully using these services will give you a jump start, especially if you’re at the beginning of your career.

Freelancer Finance Must Haves:

These are the core of my investing life — let’s take advantage of every tax deduction and investment account we can. You know, like the filthy rich do. We can play too.

INVESTMENT ACCOUNTS

The i401k (aka the Solo 401k) — The monster tax deduction and retirement investment machine. Up to a $76,500 tax deduction. Every. Year. Have $1 million+ by age 55. How? Easy, boring, steady investment.

Invested in: The Three-Fund Portfolio.The HSA — Health Savings Account. Make your out-of-pocket medical expenses a tax deduction or invest your contributions long-term.

Invested in: Money Market Account or a Three-Fund Portfolio.Roth IRA or Backdoor Roth IRA — Contribute after-tax money; it grows tax-free and is spent tax-free. You can have the i401k AND the Roth IRA.

Invested in: The Three-Fund Portfolio.Max — Get the best savings rates for your cash emergency fund. You have one, right?

Invested in: Cash.Schwab Brokerage Account — A non-retirement account to buy ETFs. Why? When you sell stocks or ETFs, you only pay a 15% capital gains tax, not your personal tax rate (you must own them for more than one year.)

Invested in: The Three-Fund Portfolio/occasional individual stocks.

TOOLS/APPSQuickbooks — It keeps you and your business organized and efficient.

Empower Dashboard — Track your net worth, savings, and investments in one place. Use the fantastic investment and retirement tools — for free!

If you do open an account with these companies sometimes they pay me a a small referral fee. Yes, you guessed it, it goes in to my i401k.