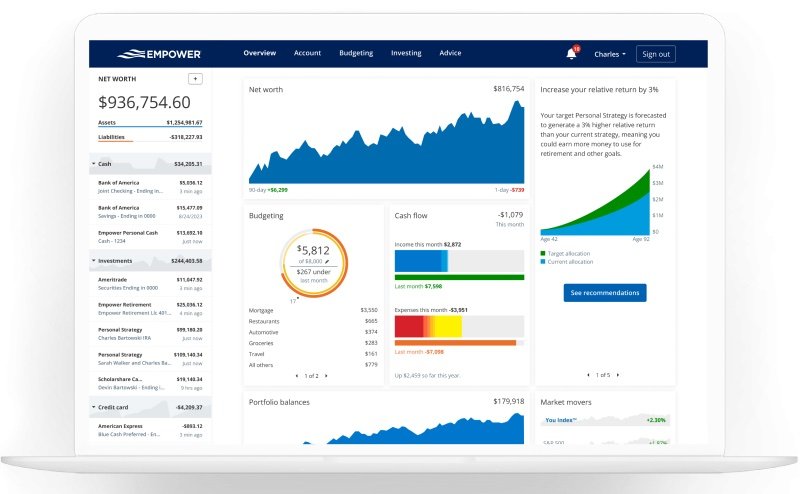

Empower Financial Dashboard — one to rule them all

Is it really wrong to love a wealth tracking website? I feel no shame.

TL;DR - too long, didn’t read

An app/website that tracks everything investment and financial in your life

Sophisticated retirement planning software

A massive time saver, all accounts for everything update automatically

It’s free!

For the first time, I could clearly see my net worth, investments, total cash balance, mortgages, and how my retirement prospects were going in one place in an easy-to-understand format. In 2015, I stayed up until 2 am in a New York hotel room, getting it all set up after I came across the dashboard; total investing geek move that one. My girlfriend noted the obvious joy as I sat in bed getting it all setup, grunted, and promptly rolled over and went to sleep. What else would you do in NY for the evening?

Did I mention it’s free?

How does it work?

After authenticating every time you start the Empower app or web version, it updates all your accounts to show you the up-to-the-minute picture of your financial and investment situation. You can check your whole financial life in one place instead of logging in to each institution or using an Excel spreadsheet. Every Saturday morning, I start it up on my iPad Pro and see where I am.

Empower offers financial advisor services, which have fees and a minimum investment amount, but the tools and dashboard are free, which I use. They will ask you if you want to have a call with one of their advisors; you can say no or have one later.

How to set it up

To get started, log into all your accounts through the Empower Dashboard, including banks, credit cards, mortgages, and pretty much anything else. Many institutions have a two-factor verification routine. Add any real estate, including your home. You can link them to Zillow or add a manual value.

You can add a manual entry for any other asset or liability (such as money you owe) that can not be added automatically.

Here are just some of the tools on the Empower Dashboard

You can use the dashboard if you’re starting out to keep track of the basics. If you've been around like me for a while and have accumulated assets, you can start to game out your retirement with the dashboard’s amazing retirement calculator.

Net Worth Tool

The Dashboard combines everything to give you your net worth. This figure is the key to everything, it’s the one to watch.

Your net worth is the value of everything you own (your assets): i401k, IRAs, trading accounts, real estate, cash accounts, and anything else you can imagine. Minus any debts you have like mortgages, student loans, or credit card debt (never carry over a credit card debt to the next month; it’s THE worst).

Why is your net worth so important? When it comes time to slow down and work less the net worth figure will drive your passive income (you are making money by doing nothing). The retirement planner (below) then shows how that will affect your slow-down phase later in life. Work less or work not at all.

Total Cash Balance

Cash is one of my favorite features on the dashboard page. Every time you log into Empower Dashboard, your accounts are updated. You can also click on each one to see all of your transactions. If you haven’t already, read The Knowledge post on where and how much to store your emergency fund cash.

Investment Profile and Analysis

Suppose you have multiple accounts: an i401k, an individual taxable account, or a 401k with a former employer. In that case, the dashboard combines all the accounts to show a complete analysis of your portfolio and the performance of each stock/ETF or fund—finally, a tool showing The Big Picture.

For example, if you have SCHB—Schwab U.S. Broad Market in multiple accounts, like an IRA and an i401k, Empower combines the holdings to show the overall performance.

The allocation section is all your investments accounts combined to show where you are invested.

Investment Checkup Tool

This tool checks your combined equities (stocks and also bonds) accounts to see where your are vs the investment profile you chose. Mine at 50 is set to aggressive. We will run the simple and effective Three Fund Portfolio in the i401k, but the tool is useful. It may tell you that you have too much cash; however, it doesn’t know we are freelance and thus need an emergency fund.

Retirement Planner

The retirement planner is amazing. It uses what’s called a Monte Carlo Simulation that runs 5,000 stock market scenarios to see how long your money will last based on the assets you have vs when you want to retire and how much you want to spend every year. This is sophisticated modeling that financial advisors often use. Is it foolproof? No, but it gives a good guide to how you are going.

The light blue is the worst case, where you can see I run out of money at around age 75. The top of the dark blue curve is the best-case scenario where I die with $2.8 million dollars.

You can add income events and spending goals and at what age they happen, such as when you retire and how much money you spend every year. Changing them will cause the simulation to run again and show you a new result, which is very useful for decision-making.

As I’ve mentioned before, I recommend talking to a financial advisor when getting close to retirement. Personally, I prefer an ‘advice-only’ advisor who charges for their advice, not a percentage of your invested money. If you’re not nearing retirement age, then the calculator is a great resource to understand how you are going.

These are just some of the analysis tools, you can pick and choose what you use. Just the home page dashboard on its own is great if you don’t want to dig into the more detailed tools.

Is it safe?

That’s the big question, right? You are putting in your passwords for EVERYTHING. Could that get hacked? Nothing is impossible, but here are the points Empower makes about its security:

No individual at Empower Personal Dashboard has access to any client credentials. Our system is designed such that not a single employee could pull them even if they tried.

We use two-factor authentication when you sign in to our site, (1) verifying your password and (2) identifying the computer you're using. If someone steals your password and tried to use it from a different computer, they cannot get in.

We encrypt your credentials and personal data with military-grade encryption algorithms -- 256-bit AES, to be specific. Even if someone could penetrate the data center, your data would remain secure.

Also you can’t do anything from the Empower Dashboard, known as ‘read only’. You can’t move money, make deposits, etc; you can only look at the tools and see transactions you have made.

The end result?

Any time you want to, you can see everything in your financial and investment life in one place. It is displayed with easy to understand charts and graphs, plus amazing retirement planning tools. I love this thing.