The Investment Website For Freelancers

Self-Employed and Solopreneurs

A freelance film crew doing their thing.

Are you tired of working gig after gig without putting your money to work so you have choices later in your career? Discover simple, sensible investing for freelancers/single-person businesses.

— We will get rich, slow —

Who runs this site? I’m Chris Albert, freelance Director of Photography, studio owner, and investment geek. I became so frustrated with the lack of help that freelancers and single business owners get that I created this site. This is educational, not financial advice. I do not receive any compensation when you open a retirement account.

Latest ‘The Knowledge’ posts

Quick posts on freelancer investing and finance

What’s the goal here?

Money is a tool, not the goal — Build up enough of an investment fund so you can slow down later and enjoy life. Your investments will begin to generate an income for you.

Kids, college, your rent/mortgage all take money, so it can be tough to invest, but try not to wait. Contribute what you can now, and ramp it up later.

Start investing simply and methodically. You don’t need to pick stocks or follow every market move. Ignore Wall Street; they want to charge you fees.

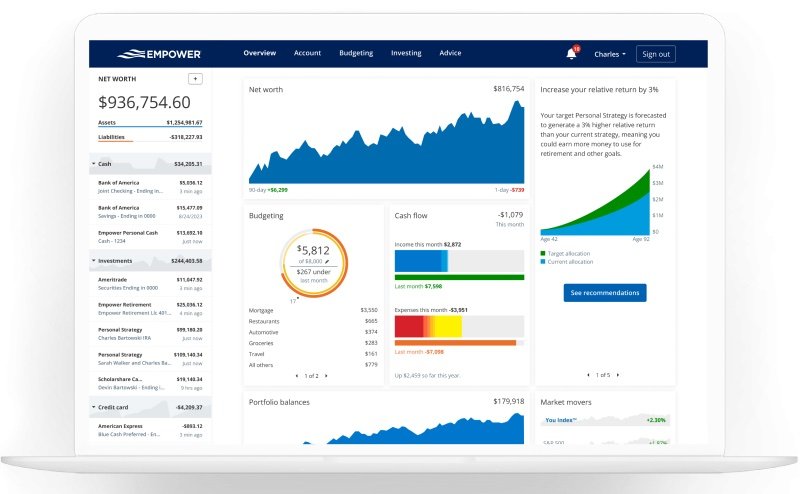

Setting up the account(s) takes an hour of setup time, then 20 minutes of your time every three months.

Your contributions and compound interest will make you rich in the background.

Investing with the Solo 401(k), also known as an Indvidual 401(k), or a One-Participant 401(k) is a massive tax deduction. The 2026 Solo 401(k), Backdoor Roth IRA and HSA Contribution Limits are here.

It’s easy to have $1 million+ in retirement, but it takes time to grow.

Earn a little more, Spend a little less, Invest the difference.

What accounts will we use?

These accounts all can hold ETFs, mutual funds, stocks, and bonds. The difference lies in if the contributions are a tax deduction going in, and how they are taxed, or not taxed at all coming out. Think of the account as a wrapper around the candy.

The Solo 401(k) also known as an Individual 401(k)—contribute up to $77,500 per year. Only for freelancers, single-person businesses, and your spouse. A massive tax deduction.

The Backdoor Roth IRA — contribute up to $8,000 per year. Pay zero tax upon withdrawal.

HSA — Health Savings Account $4,300 for singles/$8,300 per family. Tax deductible!

Taxable Brokerage Account — It’s not a retirement account, but it’s a great investment tool. Most likely, you will pay only 15% Capital gains tax, not your personal tax rate. Plus the NIIT.

Choose one single fund or three ETFs. That’s it.

What investments go inside the accounts?

Wall Street and some financial services firms won’t tell you how simple it is to create a winning, simple portfolio. Simplicity means they won’t get to charge you fees because you don’t need them.

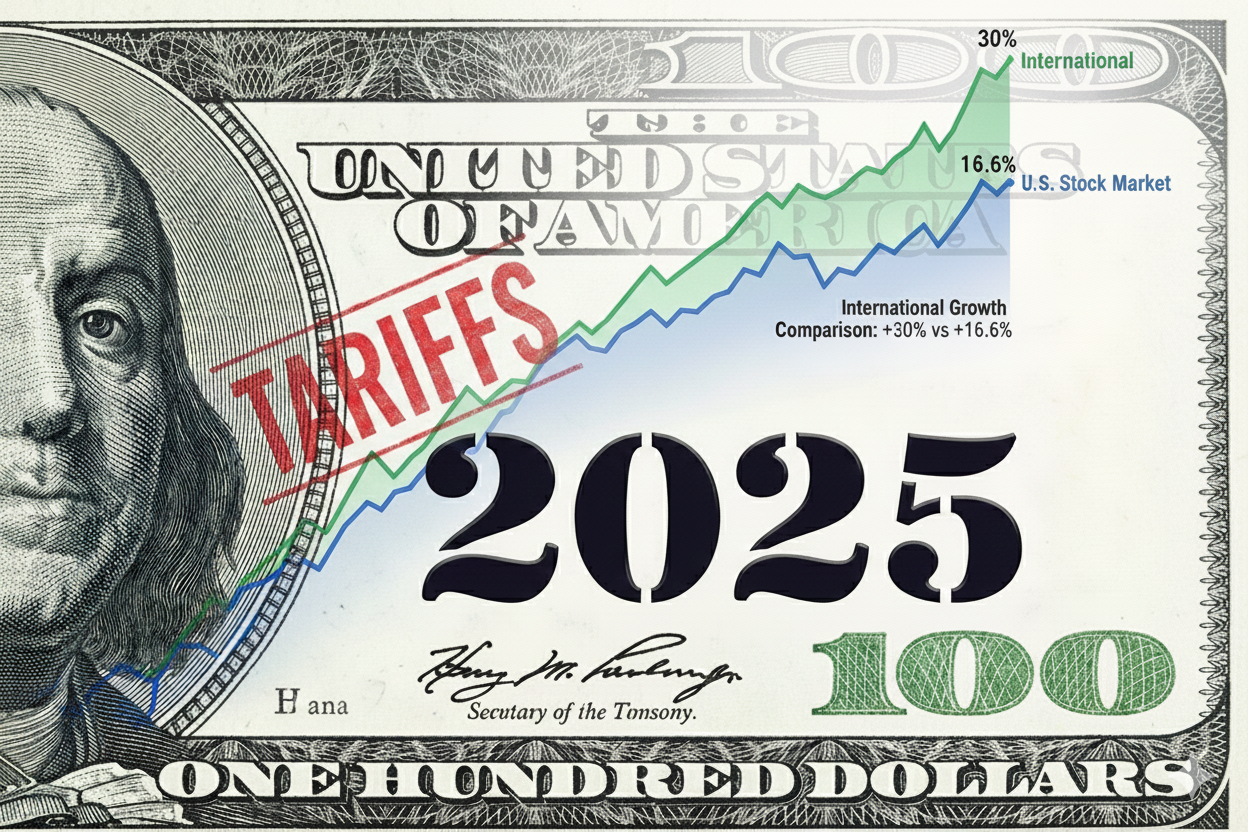

Three-Fund Portfolio—Three low-cost ETFs that contain thousands of companies: U.S. Stocks, International Stocks, and U.S. Bonds. You control the mix, and the fees are around 0.04%

Target Date Fund—One mutual fund that uses the same kind of mix as above, except the fund changes the mix for you as you get closer to retirement and need the money. Want to slow down by 2055? Choose Target Date Fund 2055. It’s that easy. Fees around 0.08%

No one can consistently outperform these ETFs or a target date fund over the long term. Ninety percent of Wall Street fund managers who charge high fees underperform the S&P 500 after a 15-year period. Check it out.

Watch your wealth grow - the magic of compounding interest

This is the magic right here and why it’s so important to start as soon as possible, even with small amounts.

The table shows compound interest in action — the snowball rolling downhill getting bigger. This example starts with $400 a month.

See what’s happening? That 7% growth compounded annually, plus your contribution, which accelerates the account's size. That’s compound interest; it grows like a monster over time.

By 55, you will have $1.5 million. Try out the calculator at the bottom of the page.

This is how you get rich, not by working yourself to death, but by investing as early as possible.

The Solo 401(k) journey - watch that sucker go.

How to get off the hamster treadmill.

Investing and learning are our best side hustle

Spend 20 minutes every three months on investing. That’s it. We use one mutual fund or three ETFs inside the Solo 401(k). It’s very simple and effective.

Investing is a long journey. Consider a 20 to 30-year time frame, not just the next few years. The stock market and your portfolio may drop in value some years; that’s okay. The stock market goes up 2/3 of the time and down 1/3 of the time.

Break the ‘plumber business model’ of making money. We don’t want to be physically there to make money. Our investments will do it for us in the background. This is ‘passive income.’

Work less later in your career because you will have a large and growing retirement fund. This means the pressure is off, allowing you to enjoy life more. That’s WHY you’re freelance. You’re the boss, not a corporate slave.

It is easy to have $1 million+ in your Solo 401(k) by age 55, especially if you start early. It’s not complicated; it's just basic investing and the magic of compound interest.

If you are at the start of your career, NOW is the time to start. TIME is what matters so that the money can grow. Don’t put it off until you earn more. It’s the early money going in that will make you wealthy. A friend started her Solo 401(k) at 27; now, at 42, she has over $740,000 invested. By the time she’s 55, it will be $2.4 million (growing at 7-8%, plus she invests $23,500 per year).

Are you well into your career? It’s never too late to start. The money will grow, and the tax deduction rocks.

It’s not your fault if you don’t know any of this. Our educators and unions have let us down. Society really sucks on this one. That’s what this website is about — one investment geek freelancer paying it forward—that and some oddball humor.

Share the site with your freelance and single-person biz colleagues. There is far too little education out there aimed at our cohort. Let’s learn together and spread the word.

Money is a tool, not a goal. We are going to get rich, slow.

It’s not hard to have well over $1 million in your Solo 401(k) by age 55. Try to start as early as possible.

Prof G (Scott Galloway), podcast guru and Professor of Marketing, NYU Stern on investing:

“The good news is, I know how to get you rich. The bad news is, the answer is slowly.”

Game on! — Next steps

This week: Grab a beverage and read the guides below. Then open a Solo 401(k) if you earn 1099 income and/or a Backdoor Roth IRA, and also a HSA if you qualify. If you mostly earn W-2 income, use a Roth and a HSA. Links below to the guides that explain how and why.

This month: Set up automatic contributions, even if they're small to start. Investing 10% of your pre-tax income is great; more is even better. Once in the retirement account, do not leave the money in cash. Invest it in the Three-Fund Portfolio ETFs or a Target Date Fund if the stock market is crashing, even better. Everything is on sale!

Later: Three to five years out from semi-retirement (or sooner), I would recommend consulting a Certified Financial Planner (CFP). They charge a one-time fee for reviewing your financial situation, then creating an investment and spending plan. CFPs have a fiduciary duty to do the right thing by you.

Note: Before you begin the above:

Paying off any high-interest debt with an interest rate above 7%, such as credit cards and student loans. Lower-rate loans or mortgages are not as critical. Your investment portfolio will be growing at 7-8%. always measure paying of yiour debts against that figure.

Make sure you have 3-6 months of expenses in an emergency fund. Read about where to stash the cash here.

Now head to:

The Solo 401(k) guide.

The Backdoor Roth IRA is the one for you if your income is mostly W-2.

The HSA, the unappreciated tax deduction and investment powerhouse.

The Knowledge for different investment/finance articles. Start with the essential posts.

Play around with the numbers to see the magic of compound interest.

Compound Interest Calculator

Watch your money grow. Play with the numbers and see the magic of compound interest. We will get rich, slow.

Your Results

| Year | Contributed | Interest | Balance |

|---|

💡 Use 7-8% as a conservative estimate for a Three-Fund Portfolio. 10% is the long-term S&P 500 average before inflation. The real magic happens after year 15 when compound interest really kicks in. Start now — future you will be grateful.